A

Size: a a a

2021 September 30

нужно больше админов!

ł

У нас их и так довольно много

O

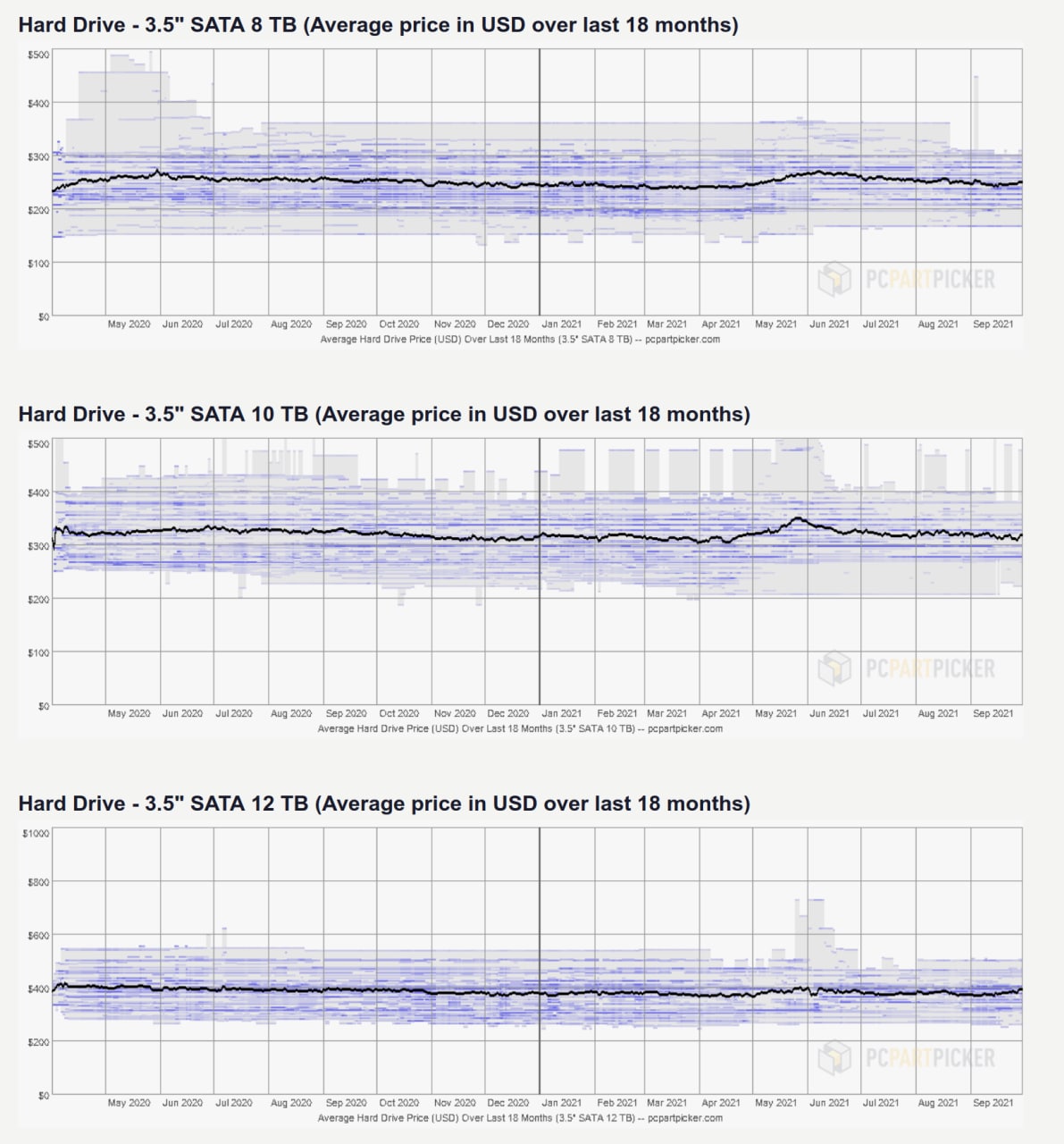

Все бы ничего, но это надо прям сильно верить в себя и в RnD в области хранения данных.

В последние годы стоимость HDD не то, что не снижается, а даже местами растет. Не самые емкие драйвы на 4Тб еще дают какую-никакую эффективность, но вот по средневзвешанным ценам за 18 месяцев, к примеру, снижения стоимости не видно ни по какой емкости HDD. Скорее даже всплески на подъем есть (но это кажется крипта постаралась и оно откатилось уже почти). $0.033 за ГБ для 12 Тб драйвов. Самые дешевые, как я уже говорил, это 4ТБ (там как раз около 0.015), но в 2021 году закупать 4Тб драйвы, при современных то объемах хранения...

В последние годы стоимость HDD не то, что не снижается, а даже местами растет. Не самые емкие драйвы на 4Тб еще дают какую-никакую эффективность, но вот по средневзвешанным ценам за 18 месяцев, к примеру, снижения стоимости не видно ни по какой емкости HDD. Скорее даже всплески на подъем есть (но это кажется крипта постаралась и оно откатилось уже почти). $0.033 за ГБ для 12 Тб драйвов. Самые дешевые, как я уже говорил, это 4ТБ (там как раз около 0.015), но в 2021 году закупать 4Тб драйвы, при современных то объемах хранения...

O

Не, деньги инвесторов конечно потерпят, нынче деньги дешевые, но все таки мне кажется, что нифига они на этом не зарабатывают и зарабатывать не планируют, по крайней мере прямо:) Это скорее попытка демпинга, что в целом совпадает с их трендом конкуренции с другими клаудами.

СА

Слушай, у них маркет кап 35 ярдов (и это после того, как бумага упала почти на 20% за последнюю неделю). Они выдержат пару десятков миллионов убытков на горизонте 2-3 лет.

O

Да я в общем-то про это и говорю. У меня есть стойкое ощущение, что очень много компаний в современном мире - они не про зарабатывание денег, они про "импакт" и вся их стоимость - биржевая по сути. Иначе я многие ходы и мультипликаторы объяснить просто не могу:)

S

О, а откуда такие графики?

R

S

AA

Каждый раз смешно. Но на этот раз пуш вел на Гитхаб, где выдало 404 страницу.

СА

Они публичная компания, все данные доступны. Q2 revenue у них были 150 лямов, +50% год к году.

ЕП

А куда именно на гитхабе?

AA

Там был внутренний браузер и в Сафари не сохранился, кажется.

Вроде был github.com/melomen

Вроде был github.com/melomen

O

Это лучше целиком приводить:

Revenue: Total revenue of $152.4 million, representing an increase of 53% year-over-year.

Gross Profit: GAAP gross profit was $117.4 million, or 77.0% gross margin, compared to $75.6 million, or 75.8%, in the second quarter of 2020. Non-GAAP gross profit was $118.9 million, or 78.0% gross margin, compared to $76.6 million, or 76.8%, in the second quarter of 2020.

Operating Loss: GAAP loss from operations was $28.9 million, or 18.9% of total revenue, compared to $24.7 million, or 24.8% of total revenue, in the second quarter of 2020. Non-GAAP loss from operations was $4.0 million, or 2.6% of total revenue, compared to $9.5 million, or 9.5% of total revenue, in the second quarter of 2020.

Net Loss: GAAP net loss was $35.5 million, compared to $26.1 million in the second quarter of 2020. Non-GAAP net loss was $7.3 million, compared to $9.6 million in the second quarter of 2020. GAAP net loss per share was $0.12, compared to $0.09 in the second quarter of 2020. Non-GAAP net loss per share was $0.02, compared to $0.03 in the second quarter of 2020.

Cash Flow: Net cash flow from operating activities was $7.5 million, compared to $4.0 million for the second quarter of 2020. Free cash flow was negative $9.8 million, or 6% of total revenue, compared to negative $20.2 million, or 20% of total revenue, in the second quarter of 2020.

Cash, cash equivalents, and available-for-sale securities were $1,033.5 million as of June 30, 2021.

У них убыток вырос до 35.5 миллионов, в сравнении с 26.1. -9.8 миллиона кэшфлоу, но оно выравнивается, вроде.

При этом они стоят 35 миллиардов. По ревеню мультипликатор 57 к капитализации. По прибыли - бесконечность, т.к. они убычны.

Revenue: Total revenue of $152.4 million, representing an increase of 53% year-over-year.

Gross Profit: GAAP gross profit was $117.4 million, or 77.0% gross margin, compared to $75.6 million, or 75.8%, in the second quarter of 2020. Non-GAAP gross profit was $118.9 million, or 78.0% gross margin, compared to $76.6 million, or 76.8%, in the second quarter of 2020.

Operating Loss: GAAP loss from operations was $28.9 million, or 18.9% of total revenue, compared to $24.7 million, or 24.8% of total revenue, in the second quarter of 2020. Non-GAAP loss from operations was $4.0 million, or 2.6% of total revenue, compared to $9.5 million, or 9.5% of total revenue, in the second quarter of 2020.

Net Loss: GAAP net loss was $35.5 million, compared to $26.1 million in the second quarter of 2020. Non-GAAP net loss was $7.3 million, compared to $9.6 million in the second quarter of 2020. GAAP net loss per share was $0.12, compared to $0.09 in the second quarter of 2020. Non-GAAP net loss per share was $0.02, compared to $0.03 in the second quarter of 2020.

Cash Flow: Net cash flow from operating activities was $7.5 million, compared to $4.0 million for the second quarter of 2020. Free cash flow was negative $9.8 million, or 6% of total revenue, compared to negative $20.2 million, or 20% of total revenue, in the second quarter of 2020.

Cash, cash equivalents, and available-for-sale securities were $1,033.5 million as of June 30, 2021.

У них убыток вырос до 35.5 миллионов, в сравнении с 26.1. -9.8 миллиона кэшфлоу, но оно выравнивается, вроде.

При этом они стоят 35 миллиардов. По ревеню мультипликатор 57 к капитализации. По прибыли - бесконечность, т.к. они убычны.

ЕП

Спасибо

СА

Ничего не знаю, я уже 2% на отскоке заработал)

СА

Потенциально они второй AWS, или третий Azure. Конечно оценка космическая, но вот такое настроение на рынке сейчас.

O

Мне вот реально сильно интересно, кто первый сделает ошибку, обвалит свою капитализацию и инициализирует падение в пропасть...

O

Главное чтобы это случилось не раньше чем через полтора года, а то я не успею уйти в электрики и обслуживание кондиционеров..

O

Переживаю немного, да. А то я тут в стартап пришел работать..)