s

Size: a a a

2020 February 19

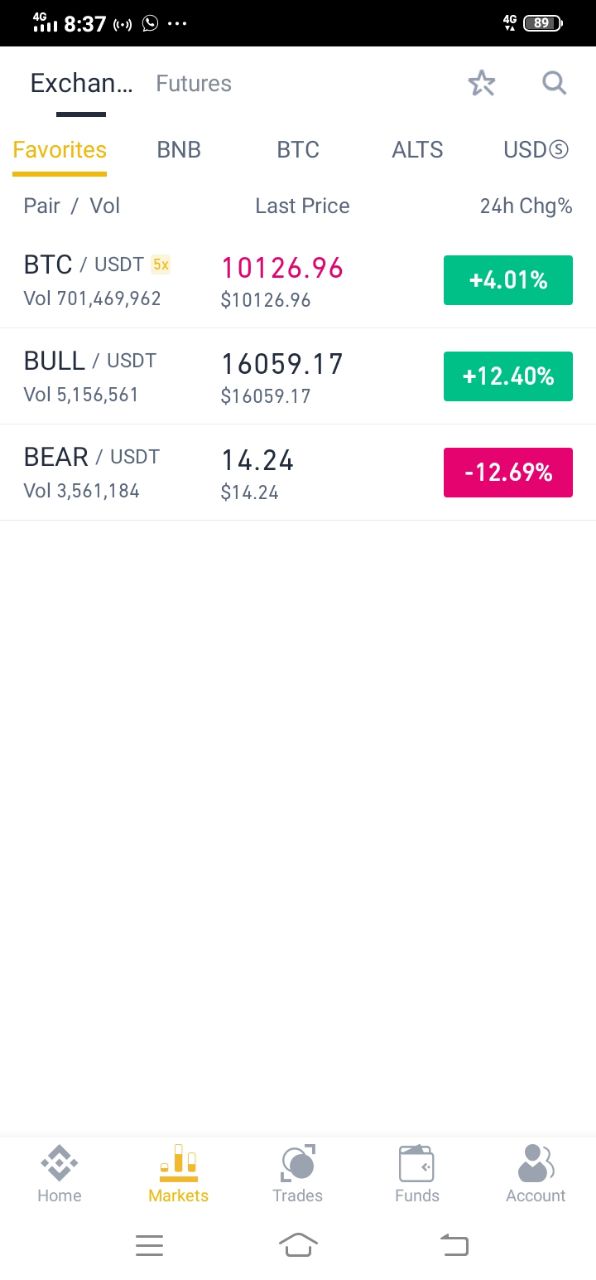

Вот поэтому батю шортить нельзя, нужно шортить говно

d

Эфир бы 300 коснулся

d

Вот тогда бы считал наварчик

I

Но пока эфиру двойную вершину можно притянуть

C

За уши)

I

Хотя бы так)

f

Вот поэтому батю шортить нельзя, нужно шортить говно

Имхо зис ис дзен

HA

А потом бан на канал за спам

бб

Вот поэтому батю шортить нельзя, нужно шортить говно

его и нужно шортить) можно и с гавном всяким конечно) кто интересуется , одно без другого не ходит просто

бб

пока ещё и не думал крыть шорт даже, на 9к

бб

cкамом так себе игратся всяким низколиквидным) его можно утащить куда угодно

AG

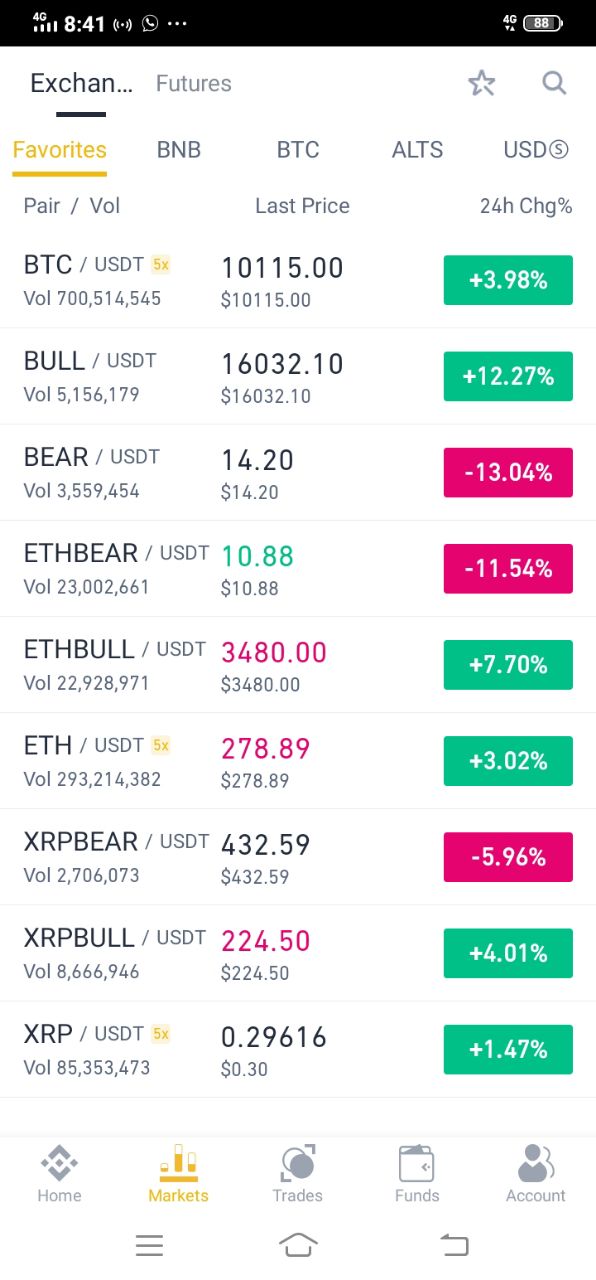

Чет не пойму почему 14?

AG

рипл bear 432, а бтс 14 .... как эти цены формируются вообще?)

N

How Do Leveraged Tokens Work?

Each leveraged token gets its price action by trading FTX perpetual futures. For instance, say that you want to create $10,000 of ETHBULL. To do so you send in $10,000, and the ETHBULL account on FTX buys $30,000 worth of ETH perpetual futures. Thus, ETHBULL is now 3x long ETH.

You can also redeem leveraged tokens for their net asset value. To do that, you can send your $10,000 of ETHBULL back to FTX, and redeem it. This will destroy the token; cause the ETHBULL account to sell back the $30,000 worth of futures; and credit your account with $10,000.

This creation and redemption mechanism is what ultimately enforces that the leveraged tokens are worth what they're supposed to

Each leveraged token gets its price action by trading FTX perpetual futures. For instance, say that you want to create $10,000 of ETHBULL. To do so you send in $10,000, and the ETHBULL account on FTX buys $30,000 worth of ETH perpetual futures. Thus, ETHBULL is now 3x long ETH.

You can also redeem leveraged tokens for their net asset value. To do that, you can send your $10,000 of ETHBULL back to FTX, and redeem it. This will destroy the token; cause the ETHBULL account to sell back the $30,000 worth of futures; and credit your account with $10,000.

This creation and redemption mechanism is what ultimately enforces that the leveraged tokens are worth what they're supposed to

AG

Как работают токены с кредитным плечом?

Каждый маркер с левереджем получает свое ценовое действие, торгуя вечными фьючерсами FTX. Например, скажем, что вы хотите создать ETHBULL за 10 000 долларов. Для этого вы отправляете 10 000 долларов, а на счету ETHBULL на FTX приобретается вечный фьючерс на ETH на 30 000 долларов. Таким образом, ETHBULL теперь в 3 раза длиннее ETH.

Вы также можете выкупить кредитные токены за их чистую стоимость. Для этого вы можете отправить свой ETHBULL за 10 000 долларов обратно в FTX и выкупить его. Это уничтожит маркер; заставить счет ETHBULL продать фьючерс на сумму 30 000 долларов США; и пополните свой счет на 10000 долларов.

Этот механизм создания и выкупа в конечном итоге обеспечивает то, что токены с кредитным плечом стоят того, что они должны

Каждый маркер с левереджем получает свое ценовое действие, торгуя вечными фьючерсами FTX. Например, скажем, что вы хотите создать ETHBULL за 10 000 долларов. Для этого вы отправляете 10 000 долларов, а на счету ETHBULL на FTX приобретается вечный фьючерс на ETH на 30 000 долларов. Таким образом, ETHBULL теперь в 3 раза длиннее ETH.

Вы также можете выкупить кредитные токены за их чистую стоимость. Для этого вы можете отправить свой ETHBULL за 10 000 долларов обратно в FTX и выкупить его. Это уничтожит маркер; заставить счет ETHBULL продать фьючерс на сумму 30 000 долларов США; и пополните свой счет на 10000 долларов.

Этот механизм создания и выкупа в конечном итоге обеспечивает то, что токены с кредитным плечом стоят того, что они должны

AG

я не бухаю уже месяц и всё равно не понимаю )

AG

почему у рипла bear дороже чем bull?) его типо на нули сольют? 😂

I

почему у рипла bear дороже чем bull?) его типо на нули сольют? 😂

До 0.13 пока только

C