AC

This one is a recent thing - a merger of AMPL's rebases and fair launch of YFI: https://medium.com/@yamfinance/yam-finance-d0ad577250c7

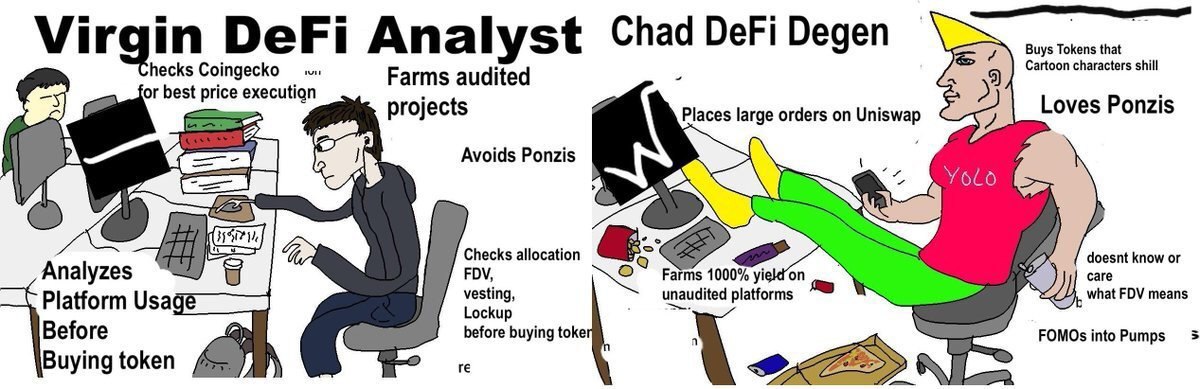

This is what the creators try to portray to quite literally scam the unaware retail. But these projects are basically all the same: they launch liquidity mining and hype the fair launch narrative. Surely, you cannot lose money here unless the contracts are rigged (it seems fine here at first glance?) because you get it for free - but because the coin has no utility - it has no meaning or value, literally.

In fact, yCRV/YAM pool launches only later, so this is kind of scammy. You first mine YAM with governance coins and then you need to insert real liquidity in there for stage 2...

I hope the market soon exposes the high-ranked people involved in some of these. You cannot say "we launched an experiment and raised 0". You used your platforms, reputation, connections. You are well aware the retail willl jump in. You don't have any intention to build real value with this. This is dusgusting. You cannot say "oh governance coin community decides". Horse shit.

Real founders worked through bear to launch some cool stuff like curve, yearn, and others. Scammers are now fucking retail over on what they have built.

And it's always like that, obviously, but it's sad to see high-profile people involved in these.

PS: surely you can go make money, fine 🌾🤷 But endorsing it is brainded. And be careful.

---------

-> a portion of each supply expansion is used to buy yCRV (a high-yield USD-denominated stablecoin) and add it to the Yam treasury, which is controlled via Yam community governance.

1] Phase 2 launches with yCRV/YAM pool

2] The price will still be insanely high

3] Rebase happens soon after https://uniswap.org/blog/uniswap-v2/#price-oracles

4] A fuckton of YAM is basically automatically dumped into the pool to get out more yCRV

5] This obviously makes the price of YAM go down because that's how the pool would work

6] People who deposited into pool 2 get a lot of YAM instead

7] Then the treasury will get a lot of yCRV to support, to protect from negative rebases

So if I understand this correctly, you basically will be royally fucked to absolute shit if you deposit into the phase 2 pool at a rate of anything above 1. Because at least with AMPL afaik, the rebase gave you coins - while here it automatically sells them into the pool. So it literally makes the price go to $1 as it is supposed to.

So would you say the best strategy to sell is during the phase 2 launch when a ton of liquidity is getting added. And then never touch it because rebases will dump it into $1.

And considering that, the ecosystem will obtain a huge amount of yCRV in that case. Which will be in the hand of YAM holders.

<->

So you will have constant yCRV extraction from the pool by dumping YAM for it - more yCRV obtained, YAM price at $1

So eventually with fomo and big price the reserve will obtain a huge organic real liquidity pool for YAM

Ok then the pool could get so large, the governance can decide to just cut the entire product thingy and distribute the reserves to themselves?

Ye so a true balance on either side. Not with 100% reserves ever, but 100% will never basically be required.

However, that makes the pool sussectible to an exit scam - you will not have 1:1 ratio there most likely

1. You will get about XYZ coins circulation and only a small % of that in the phase 2 pool

2. Most of the IL in phase 2 will become reserves of yCRV

3. That will only be a small fraction of reserves

Beyond that the protocol does not function?